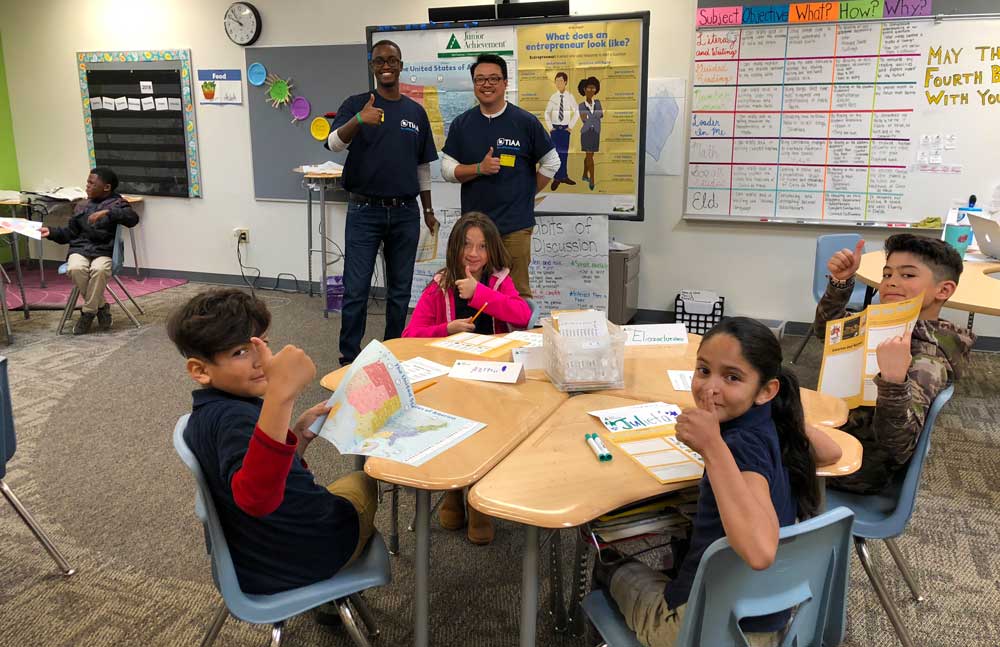

JA and TIAA tackle the taboo subject of talking about money with kids

Talking about finances can feel a bit taboo, but money is everywhere in our lives and impacts our families and goals. With national financial literacy month upon us, it is the perfect time to talk about why financial education for young people is so important to prepare them for success.

JA volunteers work with kids beginning at the kindergarten level. Is that too young of an age to talk about money?

“We start talking to them about needs and wants and how money moves around a system,” says Mike MacDonnell, JA-Rocky Mountain’s Chief Learning Officer. “What is money, what do you do with money, how do you save it? Also, being an entrepreneur and what that means. We can start really young with those concepts, and these kids get it. They are engaged.”

“Kids get allowance money, money to buy candy at the grocery store, or they say what they’d like for Christmas, so they are aware from a very young age about money and what it can get for them,” says Shelly Eweka, Director of Central Advice at TIAA, which is the official sponsor of JA’s financial literacy month. “This is an opportunity to reinforce and start educating kids on how to make those decisions. Money is everywhere in our lives, and we need to understand how it impacts everything we do. So starting in kindergarten is the perfect place to begin providing financial literacy education to children.”

Students newly entering college often begin using their own credit cards and are already making important life decisions that will impact their future. JA provides hands-on experiential learning opportunities for middle and high school students so that their learning sticks with them as they enter adulthood and are faced with real-world choices.

“We know that people with higher financial literacy scores have more positive personal financial experiences,” Eweka says. “In order for those students to make those right financial decisions, we want them to be able to have those personal financial experiences and be able to be happy with their decisions and their choices. “

Hear more of the Money Talk conversation below. Note: This interview originally aired March 22, 2019.